30 Jun 2022

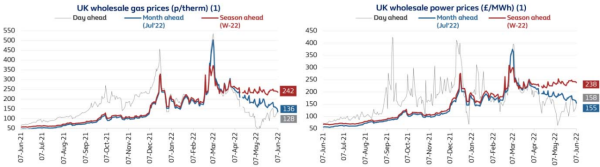

Wholesale energy prices have experienced unprecedented levels of volatility since the end of summer 2021, with both day ahead/spot and future contracts surging to all-time highs. In the last couple of months, prices have decreased but still remain high compared to a year ago. This period of high energy prices is expected to continue for the foreseeable future (see next section).

Energy prices have surged for a number of reasons:

Against this backdrop, many organisations may struggle to define how to achieve their net zero ambitions. A lack of clarity on where to decarbonise, limited understanding of their energy usage, or financial constraints can all make it difficult to know how to balance the demands of planet and profit. But companies that fail to progress their goals may face growing pressure from stakeholders and erosion of their brand’s value.

The most successful, sustainable organisations search for a balance between economic and environmental responsibility. They know that they cannot focus exclusively on rising energy costs without also considering their environmental impact – and they know that prioritising environmental concerns over financial performance would leave them without a viable business model.

Over the past two months, wholesale energy prices in the UK has declined, with rates in the day ahead market falling particularly sharply.

This is due to the UK becoming a major transit point for gas to flow into Europe. More LNG has been arriving at facilities in the UK which is then exported to continental Europe via interconnector pipelines. Two of these pipelines for instance connecting the UK to the Netherlands and Belgium have been running at capacity.

This so-called gas glut has also driven electricity exports to unprecedented highs in recent weeks as gas-fired power plants are generating more for export.

Lower energy prices in the short term markets like day ahead, where traders buy gas for immediate delivery, are having little to not effect on retail prices given that most energy suppliers buy energy months and years in advance on the forward market.

As Energy UK, the trade association for the energy industry, has explained "energy companies buy most of their energy in advance by a season or a year. This is called hedging and it helps protect suppliers from being exported to sudden price spikes" (2).

Ultimately, energy prices in the UK are driven by international gas prices and geopolitical events such as the conflict in Ukraine so the outlook is for further rises later this year.

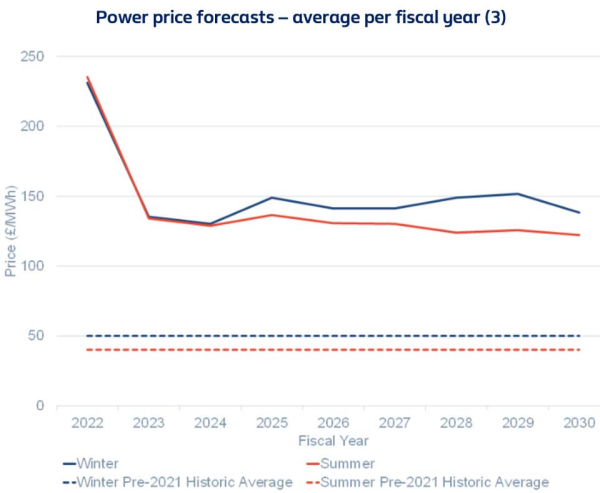

Research from Cornwall Insight looking at Great Britain’s Power Market out to 2030 suggests energy prices will remain in excess of £100/MWh annually. This is significantly above the five year pre-2021 historic average of £50/MWh in Winter and the even lower prices in pre-2021 Summer (3).

Cornwall Insight’s Benchmark Power Curve (BPC) for the British Electricity Market which covers England, Scotland, and Wales, shows that while prices will drop from the current levels, they will remain high. Prices are expected to rise to £150/MWh in Winter 2025 due to closures of nuclear power stations, delays to Hinkley C, and increasing high-cost peaking capacity.

Renewable generation capacity will rapidly increase to meet targets and will help meet rising demand; however, marginal gas-fired generation sets power prices.

As one of the UK's leading energy suppliers, we’re committed to helping businesses move closer to a net zero future. Read our report to learn how you can take action now and bounce back from volatility. Download our Executive Perspective here.

Related Articles

18th August 2022

In "Energy Efficiency"

29th January 2021

In "Energy News"

19th May 2022

In "Energy News"

The views, opinions and positions expressed within the British Gas Business Blog are those of the author alone and do not represent those of British Gas. The accuracy, completeness and validity of any statements made within this blog are not guaranteed. British Gas accepts no liability for any errors, omissions or representations. The copyright in the content within the British Gas Business Blog belongs to the authors of such content and any liability with regards to infringement of intellectual property rights remains with them. See the Fuel mix used to generate our electricity. Read about making a complaint about your business energy.