24 February 2023

In early January*, the Chancellor met with industry leaders representing business groups including the Confederation for British Industry (CBI), Institute of Directors (IoD) and UKHospitality and told them that the current level of support for businesses’ gas and electricity bills under the Energy Bill Relief Scheme (EBRS) was “unsustainably expensive” [1].

The Chancellor also said that “no government can permanently shield businesses from this energy price shock.”

Then, on 9 January, a new support scheme – the Energy Bill Discount Scheme (EBDS) – was announced to replace the EBRS that ends on 31 March 2023 [2].

So The EBRS was designed as a temporary six-month measure to support businesses through the winter by providing a discount on the commodity element (wholesale costs) of their energy bills.

The new scheme will run for a period of 12 months from April 2023 and as with the current scheme, it will cover energy contracts signed from 1 December 2021.

One key difference between the two schemes is that the eligibility bar to qualify for the support/discount has been raised to limit taxpayer’s exposure to volatile energy markets [2].

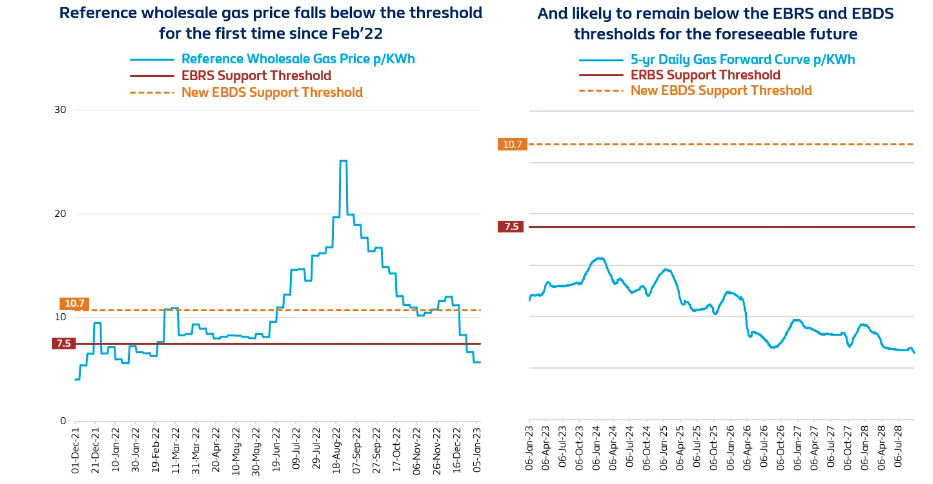

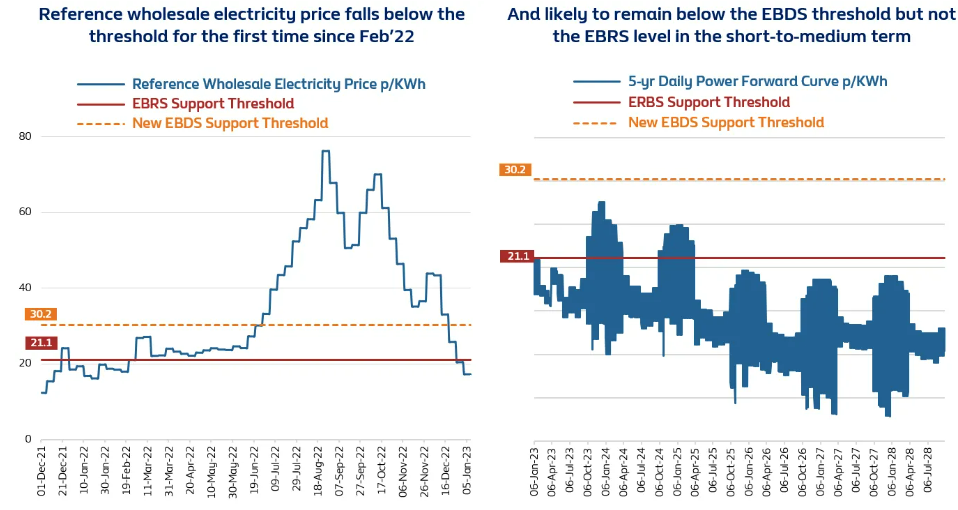

By raising the support thresholds at a time when wholesale prices have been falling and likely to remain below both the EBRS and EBDS levels for gas and the EBDS mark (but not the EBRS level in the short-to-medium term) for electricity for the foreseeable future [3], the government has been able to lower the overall cost of the assistance package from £18bn to £5bn based on estimated volumes.

Another key difference is the recognition that businesses, in what the government refers to as the Energy & Trade Intensive Industries (ETII), require additional support. According to the government, these are predominantly manufacturing industries, which are often less able to pass through cost to their customers due to international competition.

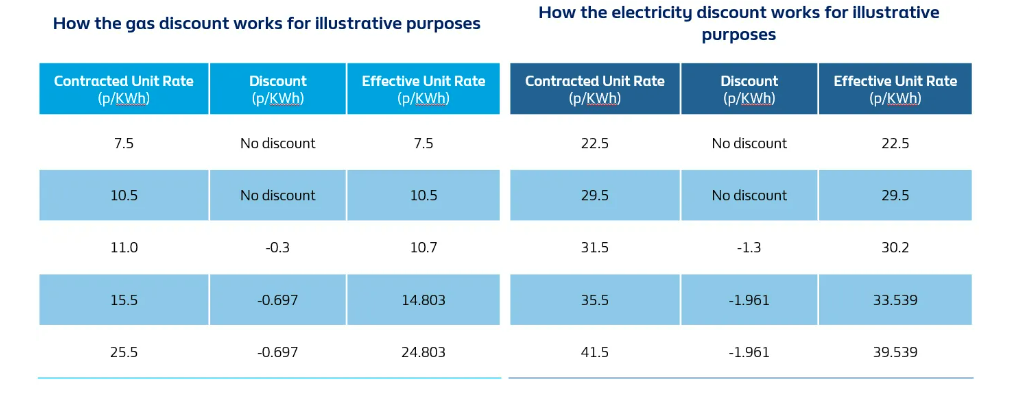

As with the current EBRS scheme, energy suppliers will automatically apply reductions to the bills of all eligible non-domestic customers, subject to a maximum discount. Eligible customers include those who agree a fixed contract on or after 1 December 2021, are on deemed or standard variable tariffs, or have a flexible supply agreement in place.

The thresholds for all businesses have been raised from:

For ETII customers, the thresholds have been set at 9.9p/KWh for gas and 18.5p/KWh for electricity and they will receive up to 4.0p/KWh off gas and up to 8.9p/KWh off electricity for 70% of their energy usage.

Eligible ETII customers will have to apply for the higher level of support. Energy suppliers will not be responsible for identifying ETII customers. The government has published a list of eligible Standard Industrial Classification (SIC) codes of economic activities that will fall into the ETII category. This is the link to the full list of eligible SIC codes.

Further information on how the ETII scheme will work will be published by the government by the end of March 2023.

As per the current scheme, the government will compensate suppliers for the reduction in wholesale gas and electricity unit prices that they are passing on to non-domestic customers.

In conclusion, the EBDS has been put in place to help businesses transition to the new higher energy price environment and avoid a cliff edge scenario.

With the outlook for energy prices still uncertain, the best thing businesses can do is maximise energy efficiencies where possible. And if you're struggling and need help with paying your business energy bills, you can get support here.

Sources & Notes:

(1) Chancellor tells business chiefs energy bill scheme is ‘unsustainably expensive’, The Independent, 4 January 2023 https://www.independent.co.uk/business/chancellor-tells-business-chiefs-energy-bill-scheme-is-unsustainably-expensive-b2256032.html

(2) Energy Bills Discount Scheme, HMS Treasury, 9 January 2023 https://www.gov.uk/guidance/energy-bills-discount-scheme

(3) Indicative 5-year daily gas and power forward curves as of 6 January 2023

*The information of this blog was correct at the time of creation in January 2023

23rd February 2023

In "Energy News"

17th March 2022

In "Energy News"

29th January 2021

In "Energy News"

The views, opinions and positions expressed within the British Gas Business Blog are those of the author alone and do not represent those of British Gas. The accuracy, completeness and validity of any statements made within this blog are not guaranteed. British Gas accepts no liability for any errors, omissions or representations. The copyright in the content within the British Gas Business Blog belongs to the authors of such content and any liability with regards to infringement of intellectual property rights remains with them. See the Fuel mix used to generate our electricity. Read about making a complaint about your business energy.